Pyrolysis/Gasification

New Waste-to-Energy Facility Energy Works Hull, United Kingdom

Adam Shore

1. Executive summary...469

2. Political background to project ...470

3. Key project stakeholders ...472

4. Timeline ...473

5. Feedstock suppliers and specification ...474

6. Site and layout ...474

7. Buildings and architectural ...475

8. Electrical connection ...476

9. Technical solution ...477

10. Mass and energy balance ...478

11. Funding ...479

12. Community benefits ...481

13. O&M interface ...482

1. Executive summary

Energy Works Hull (the Project) is a milestone project for the UK’s waste and renewable energy sector. It will be one of the largest gasification facilities receiving MSW in the UK, indeed in Europe. It is one of the first advanced conversion technology projects to receive its renewable electricity subsidies through a Contract for Difference, the mechanism by which the UK Government determined to move from Renewable Obligation Certificates following its Electricity Market Reform process. It also plays a significant part of the urban regeneration of the City of Hull. The level of community engagement and benefit has resulted in the project receiving a GBP19.9M grant from the European Union’s Regional Development Fund.

Pyrolysis/Gasification

M+W Group is a Global engineering, procurement and construction company with proven expertise in delivering major waste and energy infrastructure. The UK team was preferred EPC for the Project from an early stage and took a proactive role with the development team to ensure the Project reached financial close.

This paper introduces the Project including the site, layout, technical solution, funding and community benefits.

Development Value 150 million GBP Technology Fluidised Bed Gasification

(Advanced Conversion Technology) Installed Capacity about 28 MWe

Export Capacity about 25 MWe Construction Period 27 months (+ 3 month

advanced work programme) Operation Period 25 years

Annual RDF Throughput 240,000 tonnes Annual Net Electrical Production 190 GWh

Takeover Date 2017

Land Secured Planning Permission Granted Grid Connection Agreement Signed ERDF Grant 19.9 million GBP CFD Strike Price 119.89 GBP/MWh

EPC Contractor M+W Group

Table 1:

Key facts of the project

2. Political background to project

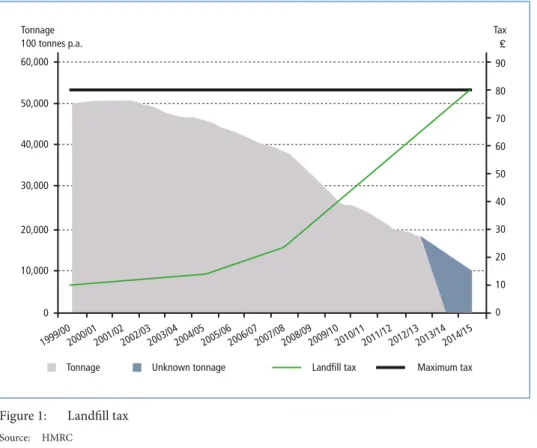

The UK Government’s target of diverting over 8M tonnes of household-derived residual waste from landfill was supported by steeply escalating landfill taxation and generous subsidies for the generation of renewable electricity in the form initially of Renewable Obligation Certificates and now Contracts for Difference. Uniquely within Europe, the UK offers significantly better subsidy levels for projects which utilise advanced conversion technologies, including gasification.

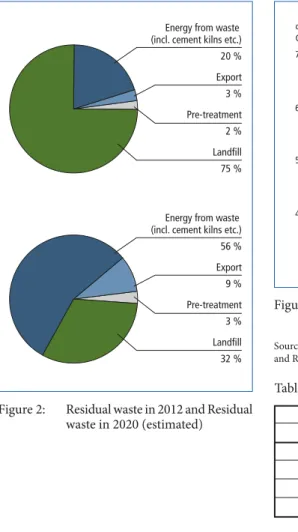

Deployment of new waste-to-energy infrastructure in response to the regulatory frame- work showed a strong increase, such that the forecast contribution of waste-to-energy to the residual waste treatment total will rise from 20 percent in 2012 to 56 percent in 2020.

Nevertheless, the UK Government remains concerned about escalating amounts of residual waste being exported, mainly to mainland Europe. It is also concerned about the increasing net electricity import, now. Around over 1GWe, which is caused mainly by closing generation facilities. Net generation within the UK reduced by 4.4 GWe between the winters of 2014 and 2015. The Government has therefore continued to show strong commitment to the development of waste-to-energy facilities.

Pyrolysis/Gasification

Against this background, Energy Works, the Project developer, sought to develop a large scale gasification facility which would have the potential to benefit from the UK environment of investment certainty, as well as receive the higher subsidy threshold open only to advanced conversion technology facilities.

Landfill tax Maximum tax

50,000

40,000

30,000 60,000

20,000

10,000 Tonnage 100 tonnes p.a.

Tonnage Unknown tonnage

0

₤ 90 80 70 60 50 40 30 20 10 0 1999/002000/012001/0

2

2002/032003/042004/052005/062006/072007/0 8

2008/092009/102010/112011/122012/132013/142014/15 Tax

Table 2: Deployment of new Waste to Energy Scheme

Pot 1 Administrative Pot 2 Administrative

(established strike price (less established strike price Pot 3 technologies) (2015/16) technologies) (2016/17)

Onshore wind 95 Offshore wind 150 biomass conversion

Solar photovoltaic 120 Wave+ 305

Energy from waste with CHP 80 Tidal stream+ 305 Hydro+ 100 technologiesAdvanced conversion 150

Landfill gas 55 Anaerobic digestion 150

Sewage gas 75 Dediciated biomass with CHP 125 Geothermal 145 Figure 1: Landfill tax

Source: HMRC

Pyrolysis/Gasification

3. Key project stakeholders

Developer – Energy Works,

Planning Consultant – Spencer Engineering, Permitting Consultant – Fichtner,

Site Lessor/Lessee – Pension Fund/Energy Works Hull,

Fuel Supplier – the facility is merchant in nature, but several European waste manage- ment companies provided an underpinning supply contract at financial close, EPC – M+W Group,

Technology Provider – Outotec Energy Products, Civils Subcontractor – Spencer Group,

Figure 2: Residual waste in 2012 and Residual waste in 2020 (estimated)

Energy from waste (incl. cement kilns etc.) 20 % Export 3 %

Landfill 75 % Pre-treatment 2 %

Energy from waste (incl. cement kilns etc.) 56 % Export 9 %

Landfill 32 % Pre-treatment 3 %

2020 75

65

55 capacity GW

2012

available capacity peak demand (high) peak demand (low) 45

Table 3: Export of RDF Export of RDF ktpa

2010 8,529 2011 250,234 2012 960,861 2013 1,799,425 Figure 3: Possible impact of plant closures on

available conventional capacity

Sources: Capacity Gap = RAE (2013); RDF = Digest of Waste and Resources Statistics (2015)

Pyrolysis/Gasification

Civils Designer/Architect – Spencer Group, PPA Provider – Engie,

District Network Operator –Northern Power, Lead Funding Arranger – Foresight,

Principal Funders – Bioenergy Infrastructure Group, Noy, Hancock Natural Resources, O&M – Engie,

STG Supplier – Siemens for STG.

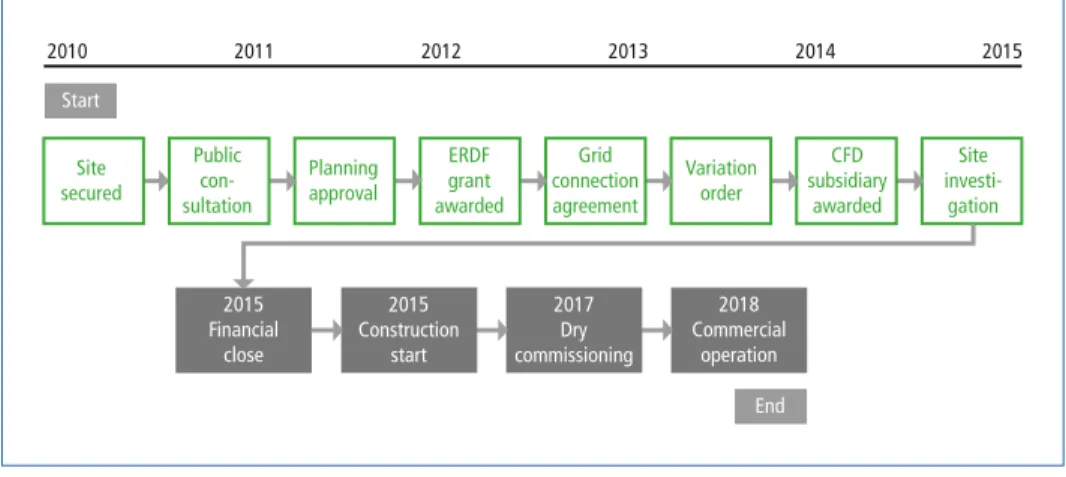

4. Timeline

Notwithstanding a comprehensive and well managed planning application process, the project still took five years from site acquisition to financial close. The project timeline was not assisted by the intervening Electricity Market Reform which meant it straddled Renewable Obligation Certificates and Contracts for Difference.

Figure 4: Project timeline

In order to be ready to qualify for the first CfD auction process and provide enough price-certainty to ensure the developer knew the price at which to bid for subsidy, M+W Group was contracted to undertake significant preliminary design work in advance of financial close and thereby at the developer’s risk.

Optimising the funding structure took up some valuable months at the end of the process to financial close. However, even with this delay, the project was the first in the UK to reach close under the new subsidy regime and achieved it more than four months earlier than the prescribed milestone date.

2010 2011 2012 2013 2014 2015

Start

Site secured

Public con- sultation

Planning approval

ERDF grant awarded

Grid connection agreement

Variation order

CFD subsidiary

awarded

Site investi-

gation

2015 Financial

close

2015 Construction

start

2017 Dry commissioning

2018 Commercial

operation End

Pyrolysis/Gasification

5. Feedstock suppliers and specification

The RDF which feeds the facility is derived from municipal, household and commercial and industrial sources.

The fuel suppliers which provided an underpinning contract at financial close included both National major waste management companies and access to smaller regional waste management companies.

The specification of RDF which formed the design basis of the facility is commercially sensitive, but represents very typical RDF composition from the mentioned sources, with a CV range of 8 to 20 MJ/kg as received at the reception.

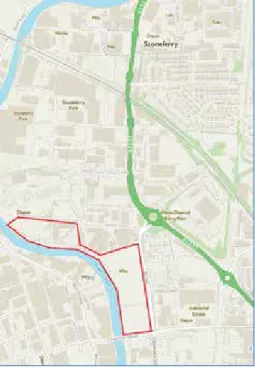

6. Site and layout

The site of the facility is located in the centre of the City of Hull, only ½ mile from the main shopping area. Whilst predominantly industrial in nature (both heavy and light), several nearby areas comprise residential elements, including a local traveller community The site itself was formerly the location of a kerosene plant and as such remediation of site contamination is extensive.

Hull was also heavily bombed during World War 2, leading to the possibility of discovering unspent munitions. Numerous other below ground obstructions are evident.

Figure 5: Site location in Hull

The River Hull is adjacent to the site and indeed delivery of feedstock by river was provided for in the planning approval, although the permitted dock is not cur- rently within M+W Group‘s scope or works.

The access to the site is via main roads, but given the central location of the site, several road closures will be necessary for the delivery of boiler sections weighing up to 200T.

Pyrolysis/Gasification Figure 6: Detailed site location

Figure 7: Site map

7. Buildings and architectural

The final design of the buildings ensures that the facility will be a landmark in the City of Hull, consistent with the City’s industrial heritage.

Pyrolysis/Gasification

The planning consent required no special architectural treatment.

Unusually, the majority of the gasification process plant will have no building over/

around it. It is only screened from public view.

Figure 8:

Visualisation of the final project

Figure 9:

BIM model showing the whole facility, with the Gasification fa- cility encompassed by the green support structure.

8. Electrical connection

The HV point of connection is very close to the site, on the other side of Cleveland Street – a 132KV substation.

The non-contestable works were minor, comprising:

• 132- 11KV transformer,

• 11KV – MV panel.

Pyrolysis/Gasification

9. Technical solution

Materials Recovery The plant is required to allow the facility to receive low quality RDF whilst still meeting the gasifier fuel specification.

The plant reduces the particle size of the RDF, and significantly reduces the level of inert materials, both metallic and non-metallic.

This is achieved by 2 stages of shredding, ferrous metal and non-ferrous metal removal and air density separation to remove non-metallic inerts.

Figure 10:

Interior structure of the project

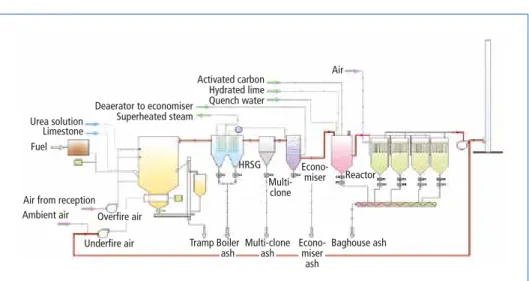

Gasification Plant

Urea solution Limestone Fuel

Air from reception Ambient air

Underfire air Tramp HRSG

Multi- clone

Reactor Activated carbon Air

Hydrated lime Quench water Deaerator to economiser

Superheated steam

Boiler

ash Multi-clone ash Econo-

miser ash

Baghouse ash Overfire air

Econo- miser

Figure 11: Gasification process

Pyrolysis/Gasification

Figure 12: The gasification facility AD

This aspect is not within M+W Group’s scope of works.

10. Mass and energy balance

OverfireUrea air Gas FuelLimestone

air Recirc

air

Staged fluidised

gasifierbed

recycleBed storageand

Single pass

boiler Econo-

miser catalystSCR

option reagentDry injection

Scrub- ber

Bag filter

Stack

Ashsilo APCR silo

ID fan Recirc

air

CEMB

APCR Ash disposal Inerts

Electrical Power Output

29,981 MW

Figure 13: The Mass and Energy Balance flow for the facility

Pyrolysis/Gasification

11. Funding

The Project investigated several funding structures before settling on an all-equity solution and reaching financial close in November 2015.

Financial close represented the conclusion of nearly five years of financing discussions.

A critical early milestone of the project was its successful award of a grant in 2013 from the European Regeneration and Development Fund of GBP 19.9 million – one of the largest of its kind in the UK. Whilst on the one hand this attribute of the project was a significant positive to help attract other funding sources – and a major success for inward investment into the city of Hull – on the other hand, it did represent an additional layer of contractual and due diligence complexity to accommodate the requirements of the European Union.

Late in 2013, the project’s sponsor, Charlie Spencer, Chairman and founder of Spencer Engineering, ran a process to select a lead arranger which was secured by the London based Foresight Group with its highly experienced and established environmental team.

The quality and commitment of these key stakeholders cannot be over-stated and is an essential part of the foundation of a project destined to be successful.

An EPC contractor selection process was run but M+W Group did not participate due to its other commitments at the time in closing 2 other gasification projects. As it transpired, some 9 months after the original EPC contractor had been selected, the project realised that it would not conclude bankable commercial terms with its original Contractor and Foresight and Spencer approached M+W Group to step in and develop a solution capable of securing Project Finance.

Over the projects long history, various providers, including banks and funds, were tabled as potential lenders. At this time, the project was running for support under the Renewables Obligation (RO) subsidy mechanism, and the latter option would enable the sponsors to get the deal done more quickly and the facility built sooner. However, the March 2018 deadline for facilities to be built out and commissioned for the RO was looming and the successor subsidy regime, Contracts for Difference (CfD), required participation in an auction process across Q4/14 and Q1/15. The project faced the tri-lemma of:

• uncertain subsidy regime;

• uncertain auction outcome, and consequentially;

• uncertain optimal funding structure, especially given the new CfD regime included strict and penal regulations requiring the project owners to meet rigorous funding and commissioning milestones.

The project was in need of an EPC Contractor with a track record in Project Financed deals in the waste to energy sector to support it through these tricky times.

Pyrolysis/Gasification

M+W Group was able to demonstrate its deep understanding of such burdens on pro- jects and in particular, evidence its covenant strength and capability in structuring an EPC contract to make it attractive for Project Finance. M+W Group also understood well the need for the project to hedge its position on subsidy and back both schemes over the transitional period. This resulted in negotiation of an early exclusivity for M+W Group with Spencer and Foresight to develop an EPC solution with sufficient detail to allow both a compelling bid for the CfD auction process and reserve a viable position to allow the project to be built within the ROC deadline.

To achieve these two objectives in parallel, M+W Group needed to dedicate significant resources pre-contract and this required some early financial commitment and payment (from Spencer) to allow M+W to procure some early design from its supply chain as well as underwrite a share of its own investment in an accelerated bid programme and advanced works. With this comprehensive support, the project was able to make a successful bid for CfD in the auction process and in February 2015, the ROC option was dropped and the final march toward financial close began. One of only 3 Advanced Conversion Technology (Gasification) projects to win a CfD contract, the project secured a 15-year strike price of GBP 119.89 (EUR 170.99, USD 181.70) per MWh.

Time

Monthly electricity price 100

80 60 40 20 0 -20 Electricity price

₤/MWh

Market revenue

₤/MWh

FIT CfD payment

₤/MWh -40

120

Strike price

Generator pays back

Figure 14: Illustrative example of CfD mechanism

With a CfD contract signed in April 2015, which gave significant underwriting to a substantial portion of long-term revenues, the project then spent - 5 months optimising both its funding package and some of its fuel supply agreements.

Pyrolysis/Gasification

Ultimately, the project settled on an all-equity structure – with a view to bringing in long-dated debt financing either during construction or in the early stages of operation.

Equity financing for the Project was provided by such sector heavyweights as Infra- capital and the Foresight Group, via the newly-established Bioenergy Infrastructure Group (BIG). BIG, whose other two shareholders are Helios and Aurium Capital, has ambitious plans to become a leading independent power producer in the bioenergy market. The Hull project, in which it has a controlling stake, represents its second deal, following its maiden investment in a biomass plant in Cheshire.

The group is joined on Energy Works by Israeli investor the Noy Fund and US-based timber investor Hancock Natural Resource Group. Meanwhile, project developer the Spencer Group also remains a shareholder in the Energy Works (Hull) Ltd special purpose vehicle. Together, the partners provided around GBP 180 million (EUR 255.4 million, USD 270.6 million) in equity financing – on top of a GBP 19.9 million (EUR 28.2 million, USD 29.9 million) grant that the project received from the European Regional Development Fund (ERDF).

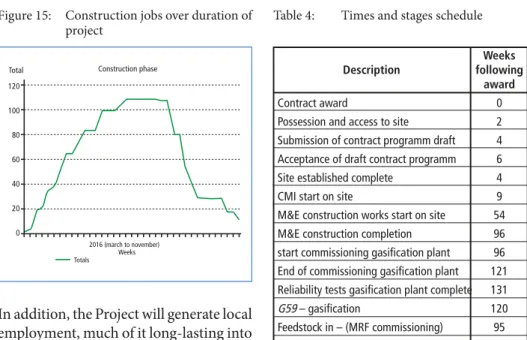

12. Community benefits

The ERDF grant was won on the basis of the project’s regeneration of the brownfield industrial site in Hull along with building and co-location of an Energy Academy teaching facility (affiliated to Hull University). PhD students will be sponsored by the Project company in each year.

Construction phase 120

100

80

60

40

20

0 Total

2016 (march to november) Weeks Totals

Figure 15: Construction jobs over duration of project

In addition, the Project will generate local employment, much of it long-lasting into operations.

Table 4: Times and stages schedule

Weeks Description following

award

Contract award 0

Possession and access to site 2 Submission of contract programm draft 4 Acceptance of draft contract programm 6 Site established complete 4

CMI start on site 9

M&E construction works start on site 54 M&E construction completion 96 start commissioning gasification plant 96 End of commissioning gasification plant 121 Reliability tests gasification plant complete 131

G59 – gasification 120

Feedstock in – (MRF commissioning) 95 Take over – gasification plant 125

Pyrolysis/Gasification

13. O&M interface

The Project company has appointed Engie (formerly GDF Cofely) as long term O&M contractor.

As such M+W Group will handover the facility to Engie following commissioning and testing. The funders did not require a detailed interface agreement between the EPC and O&M Contractors.

2.0

m

Turnaround of 6 vehicles per hour

(based on the design point RDF density of 225 kg/m3 and a 20 tonne load size)

Vehicle loading bays and tracking lines

Pedestrian exclusion zone

Figure 16:

Turnaround of 6 vehicles per hour

TK Verlag Karl Thomé-Kozmiensky

Dorfstraße 51 D-16816 Nietwerder-Neuruppin Tel. +49.3391-45.45-0 • Fax +49.3391-45.45-10 E-Mail: tkverlag@vivis.de

Waste Management, Volume 1 • Waste Management, Volume 2 • CD Waste Management, Volume 2 Waste Management, Volume 3 • Waste Management, Volume 4 • Waste Management, Volume 5

Package Price 200.00 EUR

save 85.00 EUR

Waste Management

Order your book on www. .de

or

Karl J. Thomé-Kozmiensky

WASTE MANAGEMENT

Luciano Pelloni

Thomé-Kozmiensky und PelloniWASTE MANAGEMENT

Volume 1 Eastern European Countries Karl J. Thomé-Kozmiensky

Volume 2

WASTE MANAGEMENT

Luciano Pelloni

Waste Management Recycling Composting Fermentation Mechanical-Biological Treatment Energy Recovery from Waste Sewage Sludge Treatment Thomé-Kozmiensky und PelloniWASTE MANAGEMENT

2

Thomé-Kozmiensky und Pelloni

Karl J. Thomé-Kozmiensky

Volume 3 Recycling and Recovery

WASTE MANAGEMENT

Stephanie Thiel

WASTE MANAGEMENTThomé-Kozmiensky und Thiel

3

2

1

, Thiel

5

WASTE MANAGEMENT Volume 2

KARL J. THOMÉ-KOZMIENSKY STEPHANIE THIEL HRSG.

Copyright © 2011 TK Verlag Karl Thomé-Kozmiensky Alle Rechte vorbehalten.

Das Einspeisen der Daten in Netzwerke ist untersagt.

Waste Management, Volume 1 (ISBN: 978-3-935317-48-1) Published: 2010 Hardcover: 623 pages Language: English, Polish, German Price: 15.00 EUR

Waste Management, Volume 2 (ISBN: 978-3-935317-69-6) Published: 2011 Hardcover: 866 pages Language: English Price: 50.00 EUR CD Waste Management, Volume 2 (ISBN: 978-3-935317-70-2) Language: English, Polish, German

Waste Management, Volume 3 (ISBN: 978-3-935317-83-2) Published: 2012 Hardcover: 744 pages Language: English Price: 50.00 EUR

Waste Management, Volume 4 (ISBN: 978-3-944310-15-2) Published: 2014 Hardcover: 521 pages Language: English Price: 50.00 EUR Waste Management, Volume 5 (ISBN: 978-3-944310-22-0) Published: 2015 Hardcover: 500 pages Language: English Price: 120.00 EUR Publisher: Waste Management Vol. 1 + 2: Karl J. Thomé-Kozmiensky, Luciano Pelloni • Waste Management, Vol. 3–5: Karl J. Thomé-Kozmiensky, Stephanie Thiel

Rüdiger Margraf

Waste Incineration

Figure 7:

Rough scheme dry hydration CaO Dosing balanceH2O

Dry hydrator CaO

CaO Silo

Ca(OH)2 Ca(OH)2

Silo towards lime dosing TIC

Several plants in Germany have been provided with this technology.

Figure 8 shows a plant, realised with a dry hydrator for a Ca(OH)2 production capacity of approximately 3 t/h.

Figure 8: RDF incineration plant EEW Premnitz / Germany As alternative there is the possibility to install the dry hydrator close to the additive

2 can now be injected directly into the reactor without temporary storage in a silo.

Verbrennungs-rost Gewebefilter Elektro-filter Sprüh-

trockner Kamin

Dampf-kessel MüllkranAufgabe-trichter

Müll- bunkerVerbrennungs-luftgebläseAufgabe-vorrichtungPlatten-wändeTrogkettenfördererEntschlackung/

Ammoniak-Wasser- Eindüsung

Kessel- entaschung

AbgaswäscherDruckerhöhungs-gebläse Adsorbenssilo

Feuerraum Primär-luft

Figure 3:

in München!

Universal Medien GmbH Geretsrieder Straße 10 81379 München Telefon 089 548217-0 www.universalmedien.de

Bibliografische Information der Deutschen Nationalbibliothek Die Deutsche Nationalbibliothek verzeichnet diese Publikation in der Deutschen Nationalbibliografie; detaillierte bibliografische Daten sind im Internet über http://dnb.dnb.de abrufbar

Thomé-Kozmiensky, K. J.; Thiel, S. (Eds.): Waste Management, Volume 6 – Waste-to-Energy –

ISBN 978-3-944310-29-9 TK Verlag Karl Thomé-Kozmiensky

Copyright: Professor Dr.-Ing. habil. Dr. h. c. Karl J. Thomé-Kozmiensky All rights reserved

Publisher: TK Verlag Karl Thomé-Kozmiensky • Neuruppin 2016

Editorial office: Professor Dr.-Ing. habil. Dr. h. c. Karl J. Thomé-Kozmiensky,

Dr.-Ing. Stephanie Thiel, M. Sc. Elisabeth Thomé-Kozmiensky, Janin Burbott-Seidel und Claudia Naumann-Deppe

Layout: Sandra Peters, Anne Kuhlo, Janin Burbott-Seidel, Claudia Naumann-Deppe, Ginette Teske, Gabi Spiegel und Cordula Müller

Printing: Universal Medien GmbH, Munich

This work is protected by copyright. The rights founded by this, particularly those of translation, reprinting, lecturing, extraction of illustrations and tables, broadcasting, micro- filming or reproduction by other means and storing in a retrieval system, remain reserved, even for exploitation only of excerpts. Reproduction of this work or of part of this work, also in individual cases, is only permissible within the limits of the legal provisions of the copyright law of the Federal Republic of Germany from 9 September 1965 in the currently valid revision. There is a fundamental duty to pay for this. Infringements are subject to the penal provisions of the copyright law.

The repeating of commonly used names, trade names, goods descriptions etc. in this work does not permit, even without specific mention, the assumption that such names are to be considered free under the terms of the law concerning goods descriptions and trade mark protection and can thus be used by anyone.

Should reference be made in this work, directly or indirectly, to laws, regulations or guide- lines, e.g. DIN, VDI, VDE, VGB, or these are quoted from, then the publisher cannot ac- cept any guarantee for correctness, completeness or currency. It is recommended to refer to the complete regulations or guidelines in their currently valid versions if required for ones own work.