„Solutions for the recovery of energy and materials from waste“ MARTIN plants and technologies

Plant engineering with the environment in mind

C O M B U S T I O N

D I G E S T I O N

www.martingmbh.de

49 Typical Project Structures in the Waste-to-Energy Business – EPC, EPCM, BOT, BOOT and PPP/PFI –

Policies/Strategies

Typical Project Structures in the Waste-to-Energy Business

– EPC, EPCM, BOT, BOOT and PPP/PFI –

Tobias Faber and Maria Koliasta*

1. Public private partnership and private finance initiative ...50

2. PPP Modalities – BOT, BOOT, BOO, BOLT ...52

2.1. BOT ...52

2.2. BOOT ...55

2.3. BOO ...56

2.4. BOLT ...56

3. Features of delivering construction/engineering services within PPP schemes ...56

4. Features of EPCM contract ...58

5. Literature ...60 With all waste or pollution, someone somewhere pays for it…

– Peter Seeger, American folk and social activist (1919-2014) –

Infrastructure development is undoubtedly of utmost importance for a country’s long-term economic growth and competitiveness as it affects economic activities by increasing productivity, endorsing innovation and facilitating trade. It is also a topic for global growth.

The last decade has seen a transformation in the infrastructure market with much now resting in the hands of both the public entities and the private sector. The private sector’s involvement is decisive, bringing more funds, efficiency and expertise to the improvement of projects in various critical areas such as transportation, energy, tele- communications, wastewater, health and waste. [3]

The private sectors’ participation in (conventional) infrastructure and power, water and energy projects may be promoted through the Public Private Partnerships (PPPs). PPPs have gained considerable popularity around the world and, in particular, in emerging countries which are still significantly dependent on fiscal financing for infrastructure and energy projects. [7]

* Both authors are attorneys in the international law firm Hogan Lovells International LLP. The findings in the article represent their personal opinion and not necessarily the opinion of Hogan Lovells International LLP.

Tobias Faber, Maria Koliasta

50

Policies/Strategies

More and more often, Waste-to-Energy (WtE) projects are tendered through PPP schemes, in particular in emerging markets in Asia and the Middle East. There are several reasons for procuring WtE as PPP projects such as the lack of a state to provide all the relevant services due to its financial limitations and/or its competitive inability as well as the state’s will to improve the quality of its waste disposal amenities. Thus, the ultimate key for the cooperation between the public and the private sectors is the added value; a qualitative enhanced product or service advancing by the innovative know-how of the private sector for less cost and better accountability through the allocation of risk. [4]

There are (also) several plausible types of cooperation between the public and the private sectors, such as Build-Operate-Transfer (BOT), Build-Own-Operate-Transfer (BOOT), Design-Build-Finance-Operate (DBFO) and Build-Own-Operate (BOO), used for procuring infrastructure projects and which provide the public sector with an option of satisfying its demands by alternative ways which better corresponds to its needs.

Further, the aforementioned PPP modalities are, usually, accompanied by auxiliary agreements in relation to the construction and the operation of the project such as Power Purchase Agreements (PPAs), Heat Offtake Agreements, subcontracts such as Engineering, Procurement and Construction (EPC) contracts, Operations and Main- tenance (O&M) agreements, Grid Connection/Electricity Supply Agreements etc. All projects procured as a PPP are not cut from the same cloth and the above referenced agreements should take into consideration the particularities and requirements of a project, the governing law, the interest of the stakeholders, and the available funding methods for the parties.

This article aims to provide an overview and simplify, with illustrations, concepts behind some of the typical project structures in WtE projects.

1. Public private partnership and private finance initiative

The term PPP, loosely describes arrangements between public and private sector entities for collaboration in provision of public infrastructure and services. PPPs can typically cover a wide variety of arrangements between the public and the private sectors to deliver services and infrastructure and which are discussed in the following section.

Whilst there is no overarching definition of PPPs, there are some common features which are typically associated with PPPs. For instance, a key feature of a PPP contract is that it bundles together several project phases or functions. Subject to the type of asset and service involved, the private sector is responsible for several of these phases or functions such as [12]:

• Design – indicates the development of the project from its initial conception to construction.

• Build, or Rehabilitate – indicates, in case of a new infrastructure project, the obliga- tion of the private party to construct the project and install all the required equip- ment. Where PPPs pertain to existing assets, the private party may be responsible for rehabilitating or extending the project.

51 Typical Project Structures in the Waste-to-Energy Business – EPC, EPCM, BOT, BOOT and PPP/PFI –

Policies/Strategies

• Finance – where a PPP includes construction or rehabilitation of the project, the private party is usually also required to fund all or part of the required capital ex- penditure.

• Operate – indicates the obligation of the private party to technically operate the project.

• Maintain – indicates the responsibility of the private party to maintain the project to a specified standard over the life of the contract.

Under the traditional approach, the public sector designs, constructs, operates and maintains infrastructure, and also sets anticipated quantity and benchmarks of service quality, whilst under the PPP approach, the private sector conducts all of these aspects.

More particularly, under the PPP approach, the public entity is responsible for service provisions, although the private entity designs, constructs, operates and maintains infrastructure. Hence and at least in theory, the PPP scheme safeguards provision of services to general public, but at lower cost and better quality due to the utilization of the private-sector construction expertise and management skills as well as a life cycle approach. [11]

In light of the above, a key incentive for the government to procure and deliver infra- structure projects through a PPP scheme is the assumption that PPPs offer greater value for money compared to the traditional schemes. This is because in traditional schemes, long-term risks mostly lie with the competent governmental entity. In contrast, in a PPP scheme, risks are allocated to the party which is best able to manage, and hence reduce, the cost arising from such risks. Typically, the public entity transfers the risks to the private party releasing itself from bearing the burden of risks such as cost overruns throughout the construction period, construction delays and long-term maintenance of the facility or the asset. [9]

The Private Finance Initiative (PFI) is a type of PPP which is often financed using private sector’s debt and equity.

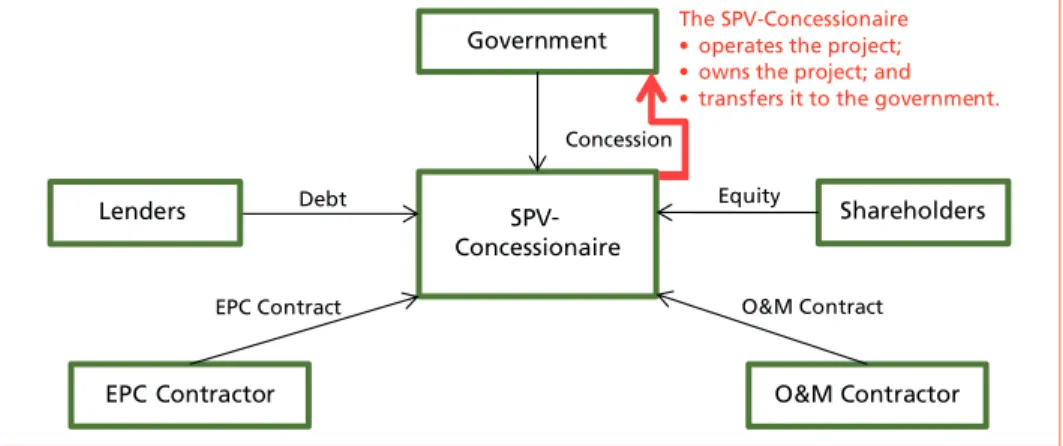

While PFI schemes might differ depending on the project and the hosting country, to give an initial bird’s eye view, the usual structure of a PFI is as outlined below. [6]

• As in PPP projects, a Special Purpose Vehicle (SPV) is established for the sole pur- pose of constructing, operating and maintaining the project. The shares in the SPV are owned by the private shareholders and certain competent governmental entities which enter into a shareholders agreement regulating their rights and obligations as shareholders as well as the management of the SPV.

• The SPV will be financed using equity and debt. Project financing has the following two characteristics:

(1) It is highly leveraged which indicates that the SPV is funded more with debt than with equity with a debt-equity ratio often being 80:20 and, hence, the banks take large part of the risk of the success or failure of the project;

(2) It is non-recourse or limited recourse which indicates that there is no or limited recourse back to the shareholders of the SPV.

Tobias Faber, Maria Koliasta

52

Policies/Strategies

• As the SPV is a newly established conduit solely for the purposes of a particular project, the credit risk tends to be considerably high at project’s inception and to shrink over the life of the project. Th us, the potential return and potential risk of the project is thoroughly assessed by the fi nancing parties.

• Oft en a syndicate of banks enter into loan agreements to fi nance the construction of the project and the repayment of the debt will be dependent on the cash fl ow generated by the operation of the project. Th ere might be various classes of banks such as international banks lending in foreign currency, local banks lending in local currency, export credit agencies or alternative direct lenders. [10]

PPA

Equity Debt

EPC Contract O&M Contract

SPV Lenders

EPC Contractor

O&M Contractor

Shareholders Government

Figure 1: Typical structure of a PPP/PFI scheme

Th e term PPP covers a wide spectrum of diff erent structures which can be used to deliver a service or a project. Depending on the country and the nature of the project, the term can cover a range of relatively short-term management arrangements, concession con- tracts, partial privatizations and long-term agreements. Further, there are diff erent PPP models that can be used such as BOT, BOOT, BOO, DBFO, Build-Operate-Lease-Trans- fer (BOLT), Lease-Develop-Operate (LDO), Rehabilitate-Operate-Transfer (ROT).

Th ese PPP models will be explained in the following section.

2. PPP modalities – BOT, BOOT, BOO, BOLT

As already introduced in the previous section, there are several plausible types of col- laboration between the public and the private sectors. Th ere is a thin line between the diff erent types which is delineated below.

2.1. BOT

Under the BOT scheme, the SPV or concessionaire retains a concession for a specifi c period from a public party for the development of a project. Such development includes

SBENG_IRRC_Wien.indd 1 14.05.2019 09:06:42

Dorfstraße 51

D-16816 Nietwerder-Neuruppin

Phone +49.3391-45.45-0 • Fax +49.3391-45.45-10 E-Mail: order@vivis.de

order now: www. .de

Strategy • Planning

Environmental Legislation

Planung und Umweltrecht, Volume 1 – 6 plus Strategie Planung Umweltrecht, Volume 7 – 11

Package Price 160.00 EUR

save 70.00 EUR

Editors: Thomé-Kozmiensky (et.al.)

Planung und Umweltrecht, Volume 4 (2010) ISBN: 978-3-935317-47-4 15.00 EUR Planung und Umweltrecht, Volume 5 (2011) ISBN: 978-3-935317-62-7 15.00 EUR Planung und Umweltrecht, Volume 6 (2012) ISBN: 978-3-935317-79-5 15.00 EUR Planung und Umweltrecht, Volume 1 (2008) ISBN: 978-3-935317-33-7 10.00 EUR Planung und Umweltrecht, Volume 2 (2008) ISBN: 978-3-935317-35-1 10.00 EUR Planung und Umweltrecht, Volume 3 (2009) ISBN: 978-3-935317-38-2 15.00 EUR

Strategie Planung Umweltrecht, Volume 10 (2016) ISBN: 978-3-944310-25-1 35.00 EUR Strategie Planung Umweltrecht, Volume 8 (2014) ISBN: 978-3-944310-07-7 25.00 EUR Strategie Planung Umweltrecht, Volume 9 (2015) ISBN: 978-3-944310-19-0 25.00 EUR Strategie Planung Umweltrecht, Volume 7 (2013) ISBN: 978-3-935317-93-1 15.00 EUR

Strategie Planung Umweltrecht, Volume 11 (2017) ISBN: 978-3-944310-33-6 50.00 EUR

Uwe Zickert

184

Neue Anlagen in Europa

2. Abfallheizkraftwerk Plymouth – Projektziele und -entwicklung Im britischen Plymouth wurde mit South West Devon Waste Partnership (SWDWP), Devon, ein 25 Jahre laufender Dienstleistungsvertrag, zur Verwertung von kommunalen Siedlungsabfällen abgeschlossen.

Einheit Mannheim Leuna Plymouth Offenbach Liberec Korbach Gersthofen

D D UK D CZ D D

Brennstoff Abfall Abfall Abfall Abfall Abfall EBS EBS

Kapazität t/a 700.000 390.000 245.000 250.000 96.000 76.000 90.000

Ofenlinien 3 2 1 3 1 1 1

Inbetriebnahme 1965 2005 2015 1970 1999 2008 2009

Strom, netto GWh/a 250 190 163 37 7 12 25

Wärme GWh/a 400 300 76 200 170 123 210

∑ Abfall 1,85 Millionen t/a ∑ Strom 684 GWh/a ∑ Wärme 1.479 GWh/a

Torridge North Devon

Mid Devon

East Devon Exeter Teignbridge Torbay West Devon

DEVON

South Hams Plymouth

Zur Erfüllung des Vertrags wurde von MVV Umwelt O&M als Generalunternehmer eine Abfallverbrennungsanlage auf dem Gelände des Verteidigungsministeriums (Mi- Zuverlässigkeit zu erreichen.

185 Konzept und Betriebserfahrungen der Abfallverbrennungsanlage Plymouth

Neue Anlagen in Europa

Bild 3:

Nach drei Jahren Bauzeit verwertet die Anlage pro Jahr 245.000 Tonnen Abfälle aus - stunden Strom und 76.000 Megawattstunden Prozessdampf. Der Dampf wird an die Damit werden jährlich 73.000 Tonnen CO2-Emissionen eingespart.

Die Investitionskosten für die Errichtung der einlinigen Anlage belaufen sich auf etwa 200 Millionen Pfund Sterling. Dem gegenüber stehen über die Vertragslaufzeit Einnahmen aus dem Behandlungsentgelt für Siedlungs- und Gewerbeabfälle, sowie aus Verkäufen von Strom und Dampf.

Das realisierte Abfallverwertungskonzept erfüllt weitere besondere Anforderungen:

• -

misch behandelt,

•

• um weniger als 5 dB(A),

• Geruchsbelästigungen in angrenzenden Wohngebieten werden vermieden und

8 9

9

10

10

Planung

Band 11 herausgegeben von

Umweltrecht

Karl J. Thomé-Kozmiensky Stephanie Thiel Elisabeth Thomé-Kozmiensky

Strategie

TK Verlag GmbH hardc

over with coloured illustrations Planung und Umweltrecht_Engl.pdf 2 12.09.18 13:26

55 Typical Project Structures in the Waste-to-Energy Business – EPC, EPCM, BOT, BOOT and PPP/PFI –

Policies/Strategies

the financing, design and construction of the facility, and also the management, op- eration and maintenance of the facility in conformity with the indicated and agreed upon technical standards. During the concession period, the concessionaire secures the return of its injected equity by operating the project. It must be noted that under the BOT scheme, the concessionaire is not the owner of the project but has the right to the returns generated from its operation. Following the expiration of the concession period, the concessionaire transfers the project to the government. [2]

The SPV-Concessionaire

• operates the project; and

• transfers it to the government.

O&M Contract EPC Contract

Equity Concession

SPV - Concessionaire

Shareholders Government

EPC Contractor O&M Contractor

Debt Lenders

Figure 2: BOT scheme

2.2. BOOT

The BOOT scheme is based on the above structure, with one major difference. Under the BOOT approach, the ownership of the project under construction also vests with the private party during the concession period. Thus, most of the risks regarding the design, management, construction, operation and maintenance are transferred to the private party. Following the expiration of the concession period, the project is trans- ferred to the competent governmental entity free of liens and at no cost. [2]

The SPV-Concessionaire

• operates the project;

• owns the project; and

• transfers it to the government.

O&M Contract EPC Contract

Equity Concession

SPV - Concessionaire

Shareholders Government

EPC Contractor O&M Contractor

Lenders Debt

Figure 3: BOOT scheme

Tobias Faber, Maria Koliasta

56

Policies/Strategies

2.3. BOO

The BOO model is a variation of the BOOT scheme in which, following the expiration of the concession period, the project is not transferred to the competent governmental entity but rather, the latter purchases the facility or the asset on mutually agreed terms and conditions. [1]

The SPV-Concessionaire

• operates the project;

• owns the project; and

• sells it to the government.

O&M Contract EPC Contract

Equity Concession

SPV - Concessionaire

Shareholders Government

EPC Contractor O&M Contractor

Lenders Debt

Figure 4: BOO scheme

2.4. BOLT

The BOLT scheme is a PPP model where the private party or concessionaire leases the facility or an asset from a public party. The private party is responsible for financing, constructing and operating the project in conformity with the technical and operational specifications agreed between the parties. In return, the private party is either allowed to collect the revenue generated from the project or paid a specified sum by the public sector. After completion of the lease period, the facility or asset reverts to the competent governmental entity. It is not so much seen in practice though. [13]

3. Features of delivering construction/engineering services within PPP schemes

In construction projects with an international dimension, it is undeniable that the pro- curement model to be implemented is directly related to the success of the project. As the infrastructure industry rapidly expands, the necessity for a variety of procurement models is also augmented in order to sufficiently address and keep up with the varying scope of work and the mutable nature of the industry.

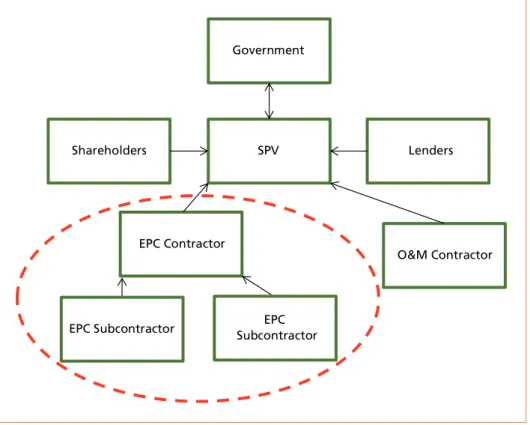

As briefly mentioned above, the PPP schemes are often accompanied by a significant number of ancillary contracts, such as EPC contracts and O&M agreements, to be executed between the several contractors and the SPV with regard to the construction and the operation of the project.

57 Typical Project Structures in the Waste-to-Energy Business – EPC, EPCM, BOT, BOOT and PPP/PFI –

Policies/Strategies

The SPV which is created solely for the implementation of a specific project will usually enter into arrangements which cover the following aspects:

• an agreement (concession/project agreement) with the competent governmental entity granting the SPV the right to construct and operate the project for a specific period of time (typically between 15 and 25 years) following which, the project should be handed over to the governmental entity;

• a construction agreement, i.e. the EPC contract, dealing with the construction of the project;

• an agreement (usually long-term) dealing with the operation and maintenance of the project; and

• financing and security arrangements with the Lenders for financing the develop- ment of the project.

The diagram reflects the basic contractual formation of a project using EPC contract.

SPV Lenders

Shareholders

Government

EPC Contractor

O&M Contractor

EPC Subcontractor EPC

Subcontractor

Figure 5: Basic contractual formation of a project using EPC contract

The EPC contracts are a type of contract used by the private sector for convoluted and large scale infrastructure projects. An EPC contract usually comprises of a detailed engineering design of the project, project management, equipment and materials, commissioning and construction of the facility or asset.

Tobias Faber, Maria Koliasta

58

Policies/Strategies

Usually, under the EPC contracts, the lion’s share of the risk is allocated to the EPC contractor. In particular, it is anticipated that the EPC contractor will be able to assess, control and assume the various risks inherent to the project. The contractor is responsi- ble for the realization of the project as well as for the fitness of purpose of the result. [8]

EPC contracts are mostly, at least if there is a financing background, also referred to as turnkey construction contracts. This is because the objective of the EPC approach is for the EPC contractor to be given the task to engineer, procure and construct the requisite works with minimal intervention of the public entity. Once these works are finalized and completed and the project is ready for operation, the project shall be handed over to the owner so that the latter needs only to turn a key to commence operating the project himself. [8]

A turnkey approach is preferred when the public entities, as owners of the project, lack the required experience or when such projects encompass extensive risks which cannot be assumed by the public entities. Hence, a key characteristic of the turnkey approach to contracting is the obligation set upon the contractor to evidence the reliability and the sufficient performance of the project and assume the risks associated thereto. In such projects, it is critical not only for the project to be timely delivered within the agreed costs but also to be capable of satisfying the intended functions expected of it.

The performance of the project is of utmost importance since, as mentioned above, these projects are mostly funded under the project financing scheme and the security of the financing parties for the repayment of their debt directly relies on the capacity of the constructed project to generate the required revenue. [8]

Frequently the EPC Contractor has to execute and deliver the project within a pre-agreed budget, commonly known as lump-sum contract. Under a lump-sum contract, a single price for all the works to be undertaken is agreed before the works are initiated. The gap between the price and the actual cost of the works to be incurred will constitute the EPC contractor’s loss or profit. Thus, substantial risk will be placed on the EPC contractor. Modification in the agreed fixed sum might be agreed in certain limited circumstances and when specifically provided for in the EPC contract. The EPC con- tractor will often be paid the lump-sum price in instalments. Such instalments reflect a schedule of payments at indicated stages of completion.

4. Features of EPCM contract

The Engineering, Procurement, Construction, and Management (EPCM) is another contract strategy which has many similarities with the EPC contract.

An EPCM contract can be said to resemble a professional services arrangement. The EPCM contractor acts as the SPV’s agent and establishes on behalf of the SPV, direct contractual relationships between the SPV and the suppliers and the contractors. The EPCM contractor will not typically take full responsibility for handing over the finalized project by a specific completion date, nor will it take responsibility for maintenance of the works.

59 Typical Project Structures in the Waste-to-Energy Business – EPC, EPCM, BOT, BOOT and PPP/PFI –

Policies/Strategies

The principal liabilities of the EPCM contractor include:

• performance of the design work;

• estimation of the project budget based on assessment of expected costs;

• preparation and assessment of the anticipated duration of the works;

• managing the procurement and administration of the construction works; and

• coordination between the design and construction works.

While the EPC contracts and the EPCM contracts have been present in the construction sector for several years, there remains misperception (or a variety in practice) as to the main differences between these contracts, particularly with respect to the responsibility of the contractors under these contracts.

In an EPC contract, the EPC contractor advances the project from the beginning to final completion. The SPV furnishes the EPC contractor with a thorough design including technical and operational specifications, in order for the EPC contractor to construct and hand over the project to the SPV on a turnkey basis, within the indicated and agreed time period. The scope of work should be precisely outlined in the contract documen- tation; hence, modifications to the scope of work are not an ordinary characteristic in EPC contracts. For this reason an EPC contract is typically a lump sum contract and any deficit of costs is a risk that lies with the EPC contractor. Conversely, the EPCM contractor is not involved in the construction and commissioning of the project at all, but is rather responsible for the thorough design and management of the project, on behalf of the SPV. The EPCM contractor is responsible for ensuring that the engineering and design of the project is in conformity with the project’s mechanical and operational specifications. As such, the main responsibilities of the EPCM Contractor are centred on organizing, supervising, managing, administrating and synchronizing construction interface in compliance with a detailed schedule for the Project. [5]

Another distinctive characteristic of the EPC contract is that the EPC contractor enters into separate arrangements with sub-contractors As far as the SPV is concerned, the overall responsibility for the project remains with the EPC Contractor due to privity of contract between the EPC contractor and the SPV. The EPC contract provisions including indemnities, liabilities and dispute resolution provisions are also structured to reflect this presumption, and any sub-contracts entered into by the EPC Contractor are executed on a back-to-back basis with mirrored responsibilities and obligations for the sub-contractors. This is to limit the exposure of the SPV to any disputes which may arise under the execution of the project towards only the EPC Contractor and disputes arising between the EPC Contractor and sub-contractor should be settled between themselves. [8]

In contrast, an EPCM contractor is responsible for instituting contractual arrangements on behalf of the SPV with all other contractors and/or sub-contractors. Particularly, the EPCM contractor is contracted by the SPV for the construction management and administration of the project, whilst a separate contract for the actual construction of the required works is entered into by the SPV, to which the EPCM contractor must offer assistance.

It is difficult to implement an EPCM scheme within a project financing.

Tobias Faber, Maria Koliasta

60

Policies/Strategies

5. Literature

[1] Akbiyikli; Eaton D.: A Comparison of PFI, BOT, BOO, and BOOT Procurement Routes for Infrastructure Construction Projects, 07/2003

[2] Bashiri M. et al.: Analytical comparison between BOT, BOOT, and PPP project delivery systems, 01/2011

[3] Basilió, M. (May, 2011): Infrastructure PPP investments in Emerging Markets. Retrieved: July, 2019, from: https://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEET- INGS/2011-Braga/papers/0337_update.pdf, from: European Financial Management Associa- tion (EFMA).

[4] European Court of Auditors: Widespread shortcomings and limited benefits. Special Report, 09/2018

[5] Hogan Lovells: EPC or EPCM contracts? 01/2016 [6] https://www.tradefinanceglobal.com/legal/spv-financing/

[7] Hyun, S.; Park, D.; Tian, S. (August, 2018): Determinants of Public-Private Partnerships in Infrasturcture in Asia: Implications for Capital Market Development. Retrieved: July, 2019 from: https://www.adb.org/sites/default/files/publication/438966/ewp-552-ppps-infrastruc- ture-asia-capital-market.pdf, from: Asian Development Bank.

[8] Klee, L.: International Construction Contracts, 01/2015

[9] Lee, H.; Kim, K.: Traditional Procurement versus Public–Private Partnership: a Comparison of Procurement Modalities focusing on Bundling Contract Effects, 09/2018

[10] Nevitt P. K.; Fabozzi F. J.: Project Financing (7th Edition)

[11] Oliveira Cruz, C.; Miranda Sarmento, J.: Reforming traditional PPP models to cope with the challenges of smart cities, 10/2017

[12] Page, A.: PPP/PFI in the UK. Practical Law UK Practice Note Overview, 12/2012

[13] Shukla, N.; Panchal, R.; Shah N.: Built-Own-Lease-Transfer (BOLT): A Public Private Partner- ship Model that Bridges Gap of Infrastructure in Urban Areas. Volume 5, Number 2, 2014

Contact Person

Dr. Tobias Faber

Hogan Lovells International LLP

Infrastructure, Energy, Resources & Projects Untermainanlage 1

60329 Frankfurt am Main GERMANY

+49 6996236161

tobias.faber@hoganlovells.com Maria Koliasta, LL.M Berkley Law Hogan Lovells International LLP

Infrastructure, Energy, Resources & Projects Untermainanlage 1

60329 Frankfurt am Main GERMANY

+49 69962360

maria.koliasta@hoganlovells.com

Vorwort

4

Bibliografische Information der Deutschen Nationalbibliothek Die Deutsche Nationalbibliothek verzeichnet diese Publikation in der Deutschen Nationalbibliografie; detaillierte bibliografische Daten sind im Internet über http://dnb.dnb.de abrufbar

Thiel, S.; Thomé-Kozmiensky, E.; Winter, F.; Juchelková, D. (Eds.):

Waste Management, Volume 9 – Waste-to-Energy –

ISBN 978-3-944310-48-0 Thomé-Kozmiensky Verlag GmbH

Copyright: Elisabeth Thomé-Kozmiensky, M.Sc., Dr.-Ing. Stephanie Thiel All rights reserved

Publisher: Thomé-Kozmiensky Verlag GmbH • Neuruppin 2019 Editorial office: Dr.-Ing. Stephanie Thiel, Elisabeth Thomé-Kozmiensky, M.Sc.

Layout: Claudia Naumann-Deppe, Janin Burbott-Seidel, Sarah Pietsch, Ginette Teske, Roland Richter, Cordula Müller, Gabi Spiegel Printing: Universal Medien GmbH, Munich

This work is protected by copyright. The rights founded by this, particularly those of translation, reprinting, lecturing, extraction of illustrations and tables, broadcasting, micro- filming or reproduction by other means and storing in a retrieval system, remain reserved, even for exploitation only of excerpts. Reproduction of this work or of part of this work, also in individual cases, is only permissible within the limits of the legal provisions of the copyright law of the Federal Republic of Germany from 9 September 1965 in the currently valid revision. There is a fundamental duty to pay for this. Infringements are subject to the penal provisions of the copyright law.

The repeating of commonly used names, trade names, goods descriptions etc. in this work does not permit, even without specific mention, the assumption that such names are to be considered free under the terms of the law concerning goods descriptions and trade mark protection and can thus be used by anyone.

Should reference be made in this work, directly or indirectly, to laws, regulations or guide- lines, e.g. DIN, VDI, VDE, VGB, or these are quoted from, then the publisher cannot ac- cept any guarantee for correctness, completeness or currency. It is recommended to refer to the complete regulations or guidelines in their currently valid versions if required for ones own work.