Behavior in Rent-Seeking Contests:

Volltext

Abbildung

ÄHNLICHE DOKUMENTE

Security sensitive interfaces are protected by stan- dard Android permissions such as PHONE CALLS, INTERNET, SEND SMS meaning that applications have to possess these permissions to

For their part, the European Union and other Western actors cannot accept Russia’s military intervention, nor the violation of international law and the Ukrainian con-

The US plus the European four should present a united front, making the Friends of Syria Group an important forum in which to push the de-escalation initiative with regional allies

available on whether the DPRK has nuclear reentry vehicles for ballistic missiles. As to the outlook for North Korea’s nuclear capability, it will depend on the

The same holds for hypothesis 12, according to which the propaganda effect of reports about violence further a text un- derstanding in favor of the victim side, if the

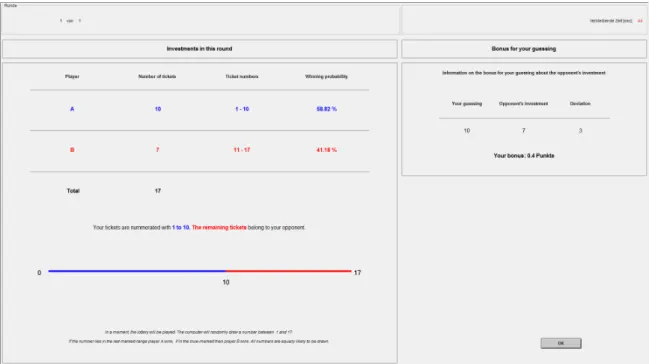

In the Hawk Treatment the probability of a manager winning the additional 1000 points was equal to the total number of points invested by his or her own group, divided by the sum

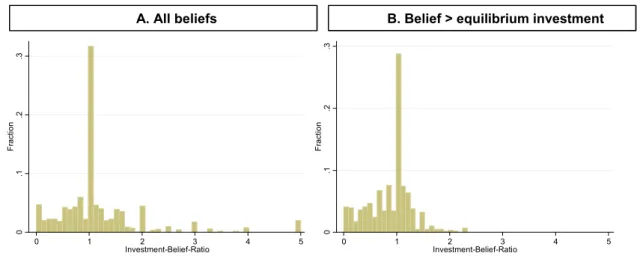

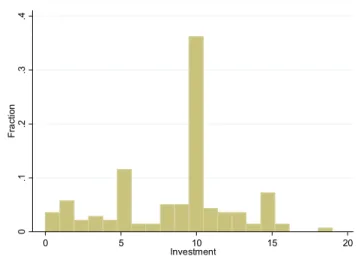

The key question in this paper is whether management incentives influence the impact of a manager’s coordination efforts. To derive predictions about this impact the analysis starts

The next step is to show that the situation in which both groups adopt the same mixed incentive scheme M with weights a 1 =a 2 =a>0 is not an equilibrium: each of the two groups